Car Depreciation for Taxes: The Ultimate Guide

By A Mystery Man Writer

Last updated 08 Jun 2024

.png)

Cars are an eligible tax deduction that can be written off over their useful life, or in some cases, expensed in the year they’re purchased. Let’s take a deep dive into the wonderful world of auto depreciation.

DoorDash Tax Deductions, Maximize Take Home Income

:max_bytes(150000):strip_icc()/relevantcost-Final-bb85c88e88bc482eba1d1ee6ad0d1461.png)

Cost Analysis of Opening an Auto Dealership - CPA Practice Advisor

Business Use of Vehicles - TurboTax Tax Tips & Videos

Complete Guide to Your Business Vehicle - Buying vs. Leasing, Standard Mileage Deduction vs. Actual Expenses Deduction with Depreciation - Honest Buck Accounting

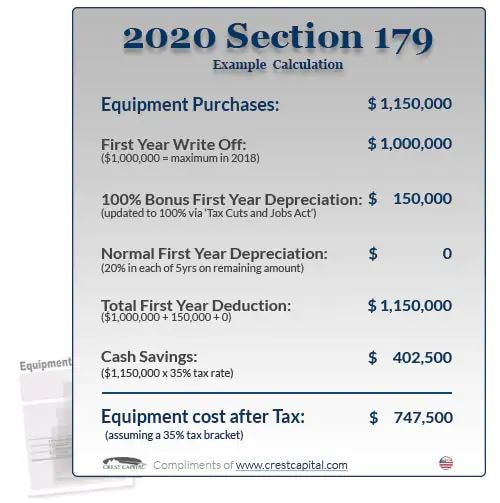

Section 179 Tax Deduction

:max_bytes(150000):strip_icc()/Form-4562-Final-98e33a07a87b491f9d3427b171ab796f.jpg)

What Is Form 4562: Depreciation and Amortization?

Car Depreciation for Taxes: The Ultimate Guide

The Best Auto Deduction Strategies for Business Owners in 2024 - Mark J. Kohler

Writing Off a Car: Ultimate Guide to Vehicle Expenses

Tax Rules For Buying A SUV Or Truck To Deduct As A Business Expense

The Complete Guide To Rental Property Taxes

Recommended for you

-

Auto Loan Rates for New & Used Cars08 Jun 2024

-

Car - Wikipedia08 Jun 2024

Car - Wikipedia08 Jun 2024 -

CarX Street on the App Store08 Jun 2024

CarX Street on the App Store08 Jun 2024 -

6 Best Cat Carriers for Car Travel in 2024 – tuft + paw08 Jun 2024

6 Best Cat Carriers for Car Travel in 2024 – tuft + paw08 Jun 2024 -

How to Write Off 100% of Your Car as a Business [STEP-BY-STEP08 Jun 2024

How to Write Off 100% of Your Car as a Business [STEP-BY-STEP08 Jun 2024 -

10 Best Careers for Car Lovers and Enthusiasts08 Jun 2024

10 Best Careers for Car Lovers and Enthusiasts08 Jun 2024 -

6 Best Banks for Car Loans08 Jun 2024

6 Best Banks for Car Loans08 Jun 2024 -

Budgeting for Car Repair Costs - Ramsey08 Jun 2024

Budgeting for Car Repair Costs - Ramsey08 Jun 2024 -

What Kind of Vinyl to Use for Car Decals – Ahijoy08 Jun 2024

What Kind of Vinyl to Use for Car Decals – Ahijoy08 Jun 2024 -

Should I Pay Cash for a New Car?08 Jun 2024

Should I Pay Cash for a New Car?08 Jun 2024

You may also like

-

Glass Markers - Metallic Wine Glass Markers Washable Wine Markers For Window Mirror Ceramics Drink Glasses Bottles - Buy Glass Markers - Metallic Wine Glass Markers Washable Wine Markers For Window Mirror08 Jun 2024

Glass Markers - Metallic Wine Glass Markers Washable Wine Markers For Window Mirror Ceramics Drink Glasses Bottles - Buy Glass Markers - Metallic Wine Glass Markers Washable Wine Markers For Window Mirror08 Jun 2024 -

Stylo 800 PCS Letter Beads for Bracelets, Colorful Alphabet Beads for Jewelry08 Jun 2024

Stylo 800 PCS Letter Beads for Bracelets, Colorful Alphabet Beads for Jewelry08 Jun 2024 -

TEHAUX 10pcs Locking Supplies pin Keepers Locking Clasp Locking pin Backs for Enamel pin Enamel pin Backs pin Back for Crafts pin Backing pin Locks08 Jun 2024

TEHAUX 10pcs Locking Supplies pin Keepers Locking Clasp Locking pin Backs for Enamel pin Enamel pin Backs pin Back for Crafts pin Backing pin Locks08 Jun 2024 -

Pipe Cleaner Flowers - ARTBAR08 Jun 2024

Pipe Cleaner Flowers - ARTBAR08 Jun 2024 -

RHS-TRM-1570-GOLD. CLEAR CRYSTAL RHINESTONE TRIM WITH GOLD BEADS - 1 INCH WIDE08 Jun 2024

RHS-TRM-1570-GOLD. CLEAR CRYSTAL RHINESTONE TRIM WITH GOLD BEADS - 1 INCH WIDE08 Jun 2024 -

Yarn Bee Ivory Yarn for Knitting & Crocheting – Jumbo08 Jun 2024

Yarn Bee Ivory Yarn for Knitting & Crocheting – Jumbo08 Jun 2024 -

AMSOIL Can-Am X3 Engine Oil and Diff Kit08 Jun 2024

AMSOIL Can-Am X3 Engine Oil and Diff Kit08 Jun 2024 -

/product/94/3659741/2.jpg?6803) Shop Generic 6inch 101 Photos Album Organizer Family Wedding Baby Memory Picture Storage Box Online08 Jun 2024

Shop Generic 6inch 101 Photos Album Organizer Family Wedding Baby Memory Picture Storage Box Online08 Jun 2024 -

ManCrafting: Dremel Stylo+Review - Lazy Guy DIY08 Jun 2024

ManCrafting: Dremel Stylo+Review - Lazy Guy DIY08 Jun 2024 -

Artfinity® Alcohol Inks08 Jun 2024

Artfinity® Alcohol Inks08 Jun 2024